An Unbiased View of Paypal Business Loan

Wiki Article

The 9-Second Trick For Paypal Business Loan

Table of ContentsThe Facts About Paypal Business Loan RevealedThe Ultimate Guide To Paypal Business LoanAn Unbiased View of Paypal Business LoanThe Greatest Guide To Paypal Business LoanPaypal Business Loan - Questions10 Simple Techniques For Paypal Business LoanGetting My Paypal Business Loan To WorkSome Known Factual Statements About Paypal Business Loan 7 Easy Facts About Paypal Business Loan Explained

There are various sort of bank loan, making it important to do your research before beginning any kind of application procedure. Hurrying the process is comparable to walking into a paint shop and telling the staff you require a container of paint, any kind will do. You would certainly end up driving house with a brand-new container of paint, but it's not likely you 'd get the one required for your specific job.If your purpose for the cash isn't clear, it's safe to say you have work to do before knocking on a loan provider's door. Produce a strong plan, and afterwards establish the details quantity of cash needed to make it take place. Additionally think about just how lengthy you would certainly such as to need to pay the cash back.

Indicators on Paypal Business Loan You Need To Know

Take notice of the dollar amounts, rates, terms, as well as various other aspects, as they're like the item details in the paint shop that will certainly aid you choose the small organization car loan kind that's flawlessly suited for your organization requirements. When adaptability is a top priority, think about a business line of debt. You can get anywhere from $1,000-$500,000, and also the cash is commonly offered in a week or 2.If you have actually stayed in business for more than half a year, are generating $50,000 or more in annual earnings, as well as have a credit report of 560 or higher, consider on your own a prime candidate. As component of the application process, a lender might require you to make a personal assurance.

The Facts About Paypal Business Loan Revealed

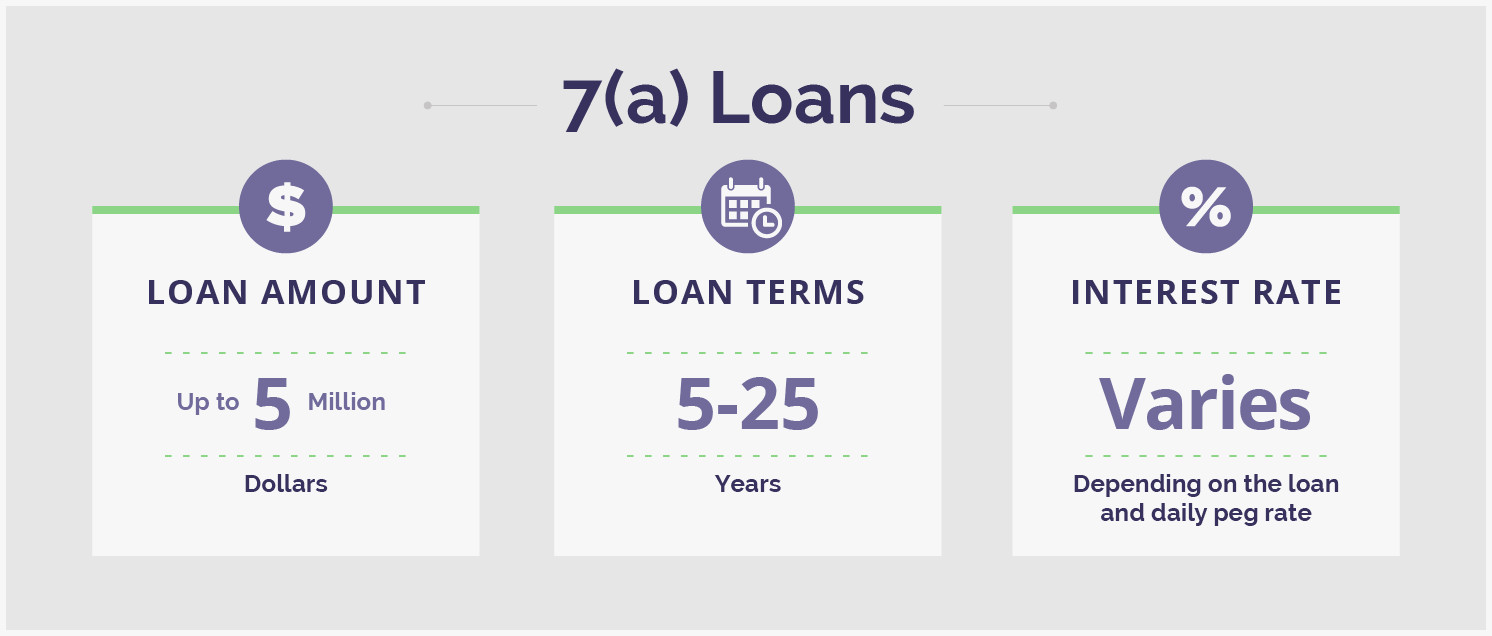

Instead, it assures a considerable portion of each financing, which minimizes various other lending institutions' risk and also makes them much more going to accept your demand (PayPal Business Loan). The SBA supplies an array of fundings to local business proprietors. Right here are a few of the most prominent choices: This car loan is the most demanded and also can be made use of for all sort of objectives.

Paypal Business Loan for Dummies

As long as you have actually got healthy debt and also have stayed in business for at the very least a couple of years, you'll remain in good condition. Sometimes, the lending institution might require read this you to secure the lending with some personal collateral (PayPal Business Loan). Typical examples of security include a home, vehicle, or property residential property.Much better yet, the interest prices begin as reduced as 6%. These lendings have a set rate of interest or flat fee, so the payments will never ever go up during the lifetime of the funding. A major benefit of this finance is it's less complicated for you to determine just how much you can manage to borrow, while likewise making it much less demanding to repay.

See This Report about Paypal Business Loan

You can get anywhere from $5,000 to $200,000, as well as time to funds can be as brief as 1 day. This kind of convenience comes with a costs rate, and you can expect the interest prices to begin around 18%. Getting a vendor money development is remarkably simple since the nature and also regards to the lending make the risk lower for a lending institution.The point is, if the purchase will certainly assist to outfit your organization for its needs, it possibly meets the criteria. One great feature of this kind of tiny business funding is that you can access the cash quickly. After sending your application, you may see funds in as low as 24 hr.

What Does Paypal Business Loan Mean?

If you would certainly favor to construct, you can utilize a commercial mortgage to pay for the building expenses. For those content looking to expand their existing residential property, you can utilize it to include square video. As well as if you're working with an older area that needs some upgrading, such a restaurant or retailer, this funding can be simply the ticket.

This funding option is an asset-based financing, so the amount and also rate of your commercial home mortgage will certainly be based upon your credit score and also the value of the residential property you'll be making use of as collateral. You can anticipate quantities ranging from $250,000 to $5,000,000. The rates of interest are usually on the lower end, beginning around 4.

The Paypal Business Loan PDFs

One of the major advantages of receivables financing is it eliminates you of the worry of finding those that owe you cash to gather on the arrearages. Rather, the loan provider will do the dirty work for you. Another vital benefit is you can qualify even if your credit is less-than-great.

The Buzz on Paypal Business Loan

So if your borrowers have excellent debt, the factoring business will certainly consider it likely that they'll pay up, meaning they'll be more going to have you transfer the invoice to them. Your credit score, in the meantime, stays mainly out of the picture. Accounts receivable financing doesn't require you to place forth any kind of security.It's the find out business that owe you cash that are examined. So you can hang on to all your personal valuables as well as not require to fret about placing them at risk at any moment. As a smart individual once said, you need to begin somewhere. The issue that entrepreneurs encounter is that some kinds of bank loan call for a significant business history to certify.

Paypal Business Loan Things To Know Before You Get This

Report this wiki page